In today’s fast-paced world, having access to emergency funds can be a lifesaver. Grameenphone (GP) has recognized this need and offers an innovative solution through its emergency minute loan service. This service allows users to borrow minutes when they run out, enabling them to stay connected even in urgent situations. In this blog post, we will explore how this service works, its benefits, and answer some frequently asked questions about the GP emergency minute loan.

How Does the GP Emergency Minute Loan Work?

The GP emergency minute loan is designed to provide customers with a quick and convenient way to borrow talk time. Here’s how it works:

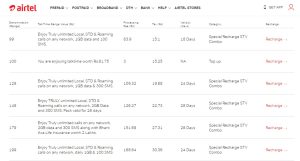

Eligibility: To be eligible for the emergency minute loan, you must be a Grameenphone prepaid user and have a history of regular usage.

Requesting a Loan: When you find yourself running low on balance, you can easily request an emergency loan by dialing a specific code provided by Grameenphone.

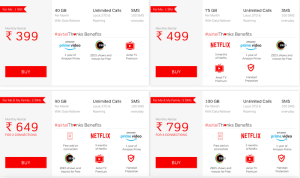

Loan Amount: The amount you can borrow typically depends on your usage history and account status.

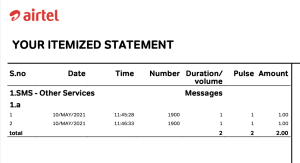

Repayment: The borrowed minutes will be deducted from your next recharge or balance refill, along with any applicable service fees.

This service ensures that you never miss an important call, especially during emergencies when every minute counts.

Benefits of the GP Emergency Minute Loan

Convenience: You can get immediate assistance without needing to visit a retailer or wait for a recharge.

Stay Connected: With the ability to borrow talk time, you can maintain communication with friends and family during critical times.

Flexible Repayment: The borrowed minutes are deducted automatically from your next recharge, making it hassle-free.

FAQs About GP Emergency Minute Loan

Q1: How do I know if I am eligible for the emergency minute loan?

A1: You need to be a Grameenphone prepaid user with a regular usage history. You can check your eligibility by dialing the specific code for emergency minutes.

Q2: What is the code to request an emergency minute loan?

A2: The specific code may vary, so it is best to check the Grameenphone website or contact customer service for the latest code.

Q3: How much can I borrow?

A3: The amount you can borrow typically varies based on your usage history and account status.

Q4: What happens if I don’t repay the borrowed minutes?

A4: If you do not repay the borrowed minutes within the stipulated period, the amount will simply be deducted from your next recharge along with any applicable fees.

Q5: Is there a service fee for borrowing minutes?

A5: Yes, there may be a small service fee associated with borrowing emergency minutes. This fee will be deducted along with the borrowed amount when you recharge.

Q6: Can I borrow minutes multiple times?

A6: Yes, you can borrow minutes multiple times as long as you remain eligible and have a good usage history.

In conclusion, the GP emergency minute loan is a valuable service for Grameenphone users who want to ensure they can always stay connected. Whether it’s for a quick call or a longer conversation during emergencies, this service offers peace of mind and convenience. Always remember to check the latest details through Grameenphone’s official channels to stay informed about the service.